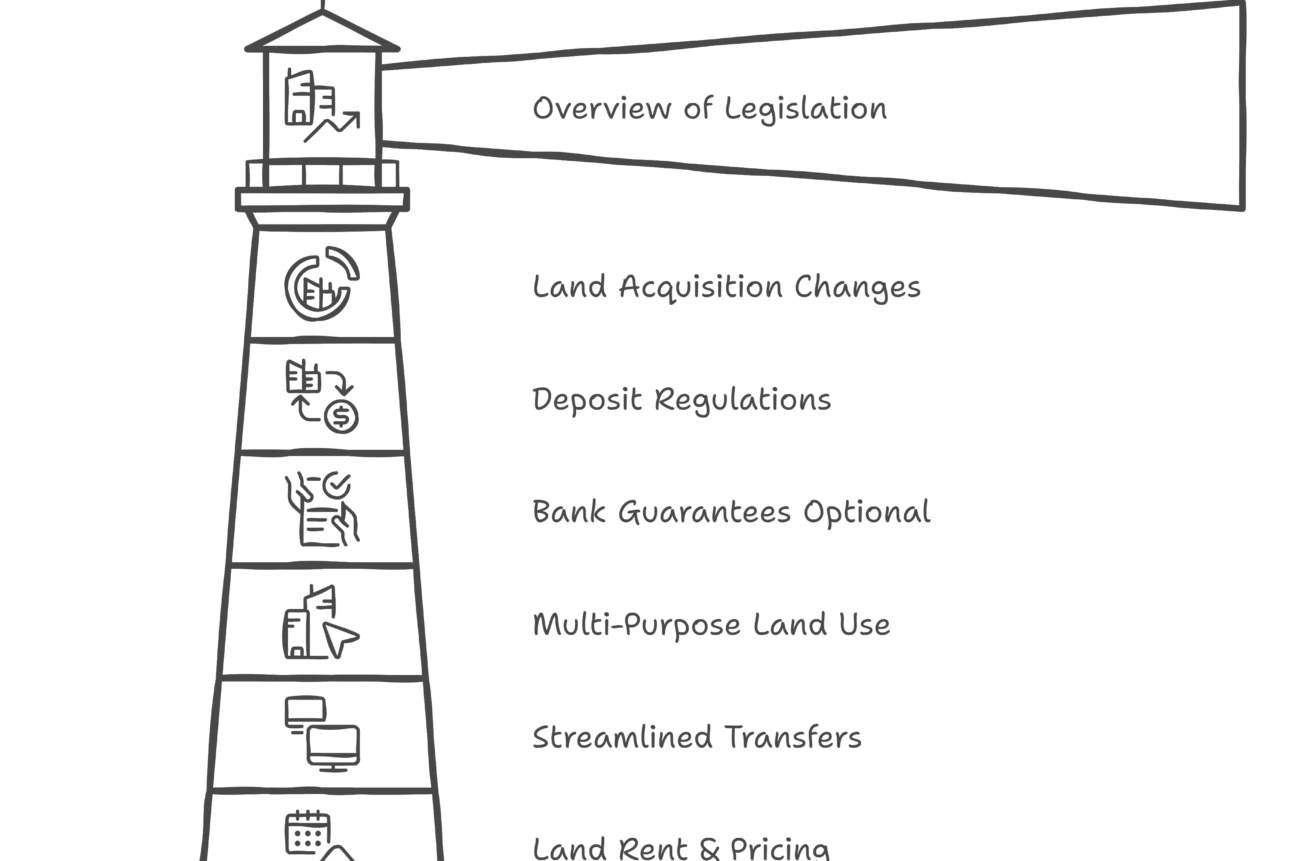

Welcome to the podcast “Don’t Do Deals in the Dark” (c)! Today, we’re diving deep into Vietnam’s real estate market, which is undergoing a significant transformation due to major legal changes enacted in 2024.

These new laws—specifically, the Land Law 2024, the Real Estate Business Law 2023, the Housing Law 2023, and the Credit Institutions Law 2024—are reshaping the very foundations of how real estate is developed, transacted, and regulated in Vietnam.

The changes are far-reaching, affecting everyone involved, from seasoned investors to everyday homebuyers. This podcast will break down the most significant shifts and what they mean for the future of the market:

- The Era of Investor-Driven Land Acquisition: A major shift is the end of government land acquisition for commercial housing projects. Investors are now tasked with securing land themselves, either through negotiations with landowners or by utilizing their existing landholdings, provided they meet legal requirements for commercial housing development. This move aims to reduce the administrative burden on state agencies, potentially leading to faster compensation and site clearance processes. However, investors now face the challenge of navigating a more complex land acquisition process, particularly foreign investors who have limited options for obtaining land-use rights.

- Safeguarding Buyers with New Deposit Regulations: To protect buyers from financial risks and curb excessive upfront fundraising by developers, the REB Law 2023 imposes stricter rules on deposits for future real estate purchases. The maximum deposit is now capped at 5% of the selling price, and it can only be collected after the property meets all occupancy conditions. While this provides greater security for buyers, it could affect the financial planning of investors who typically rely on higher deposits.

- Optional Bank Guarantees: Shifting the Balance of Power? Another notable change is making bank guarantees for future real estate purchases optional, giving buyers the right to choose whether they require this financial protection. While this offers potential cost savings for buyers—as the guarantee fee is often built into the property price—there are concerns that buyers, often in a weaker bargaining position, might not fully exercise this right.

- Unlocking Potential with Multi-Purpose Land Use: To enhance land-use efficiency and cater to evolving needs, the Land Law 2024 expands the scope for multi-purpose combined use. This opens doors for the development of hybrid real estate products like Condotels and Officetels, particularly on residential land. However, clarity is needed regarding the application of these regulations to developments on non-residential land.

- Streamlining Real Estate Project Transfers: The REB Law 2023 aims to simplify the transfer of real estate projects, eliminating the mandatory requirement for a land-use right certificate during the process. This streamlined approach saves time and money for both parties. However, careful consideration must be given to the fulfillment of financial obligations related to the land and the transfer of leasehold rights.

- From Fixed to Dynamic: Rethinking Land Rent and Pricing: Vietnam is moving away from one-time land rent payments toward an annual land rent system, aligning with the policy of “Primarily implementing the annual land rent”. While exceptions exist for certain land uses, such as agriculture, industrial parks, and social housing, the shift to annual payments exposes investors to potential cost increases due to market fluctuations. Further, the fixed land price framework has been replaced with annual adjustments to local land price tables to better reflect market dynamics. This could benefit landowners but creates financial uncertainties for investors.

- Navigating the Land Price Adjustment Equation: Adjusting local land price tables in line with the new legal framework is proving to be a complex endeavor. Balancing the need for accurate land valuations with affordability for citizens and ensuring sufficient state budget revenue without overburdening taxpayers are key considerations. Real-life examples from Ho Chi Minh City and Hanoi demonstrate the practical challenges and the need for clear guidance during this transitional period.

Beyond the topics listed above, this podcast will also examine how the new laws have expanded the scope of real estate businesses for both domestic and foreign organizations. We’ll pay special attention to the implications of the new classification system for enterprises with foreign investment capital, which differentiates between “foreign-treated” and “domestic-treated” entities, granting the latter broader real estate rights.

Join us as we analyze these key changes and their implications for investors, developers, homebuyers, and the future of Vietnam’s real estate market. Listen to the podcast here.