The Vietnamese version is available here.

Click here to download the PDF version.

On August 1, 2024, the three most pivotal legal documents within Vietnam’s real estate legal framework, namely the Land Law 2024, the Real Estate Business Law (“REB Law“) 2023, and the Housing Law 2023, came into effect. Together with certain related provisions in the Credit Institutions Law 2024, these laws are set to significantly impact the real estate market in Vietnam.

Vilasia, in collaboration with The Saigon Times, is pleased to present a series of analytical articles by Vilasia’s Nhung Nguyen on the most noteworthy new regulations in these four legal documents. The series will focus on six main topics:

(i) Methods for determining land rent and land use fees;

(ii) Conditions and procedures for transferring real estate projects;

(iii) Specific regulations on commercial housing projects;

(iv) Specific regulations on industrial park projects;

(v) Implementation of projects in the form of subdividing land lots for sale; and

(vi) Expansion of business scope for enterprises with foreign investment.

Below is the last in the series entitled “Expanding the business scope of enterprises with foreign investment capital”, originally published in Vietnamese in The Saigon Times on August 29, 2024. The digital version is available here.

____________________________

Table of Contents

Some “hybrid” enterprises will be allowed to conduct real estate business like “pure Vietnamese” enterprises

The REBL 2023 and the Land Law 2024 have made important adjustments for enterprises with foreign investment capital.

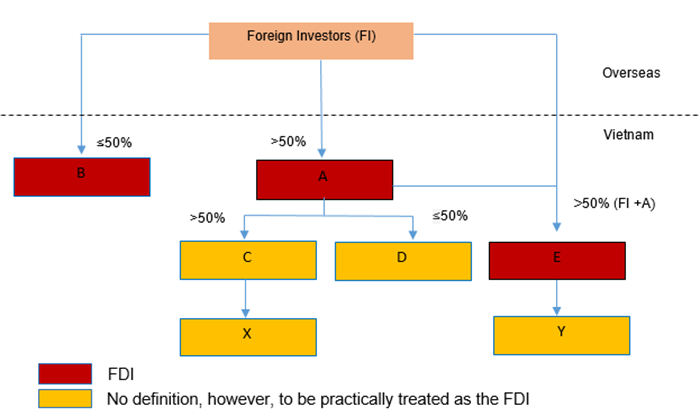

According to current regulations, the REBL 2014 only uses the term “enterprise with foreign investment capital” but does not have a specific definition, there is no distinction regarding the ownership ratio of foreign investors, whether high or low, and there is no reference clause to laws on investment. Regarding land, the Land Law 2013 defines: “Enterprises with foreign investment capital include 100% foreign-invested enterprises, joint ventures, Vietnamese enterprises in which foreign investors buy shares, merge, or acquire according to investment law regulations“[1]. With this description, all entities from 100% foreign-owned enterprises to enterprises resulting from various forms of cooperation between foreign investors and domestic investors (joint ventures, share purchases, mergers, etc.), even with only 1% foreign investment capital, are considered Enterprises with foreign investment capital (See A, B, and E in Table A below).

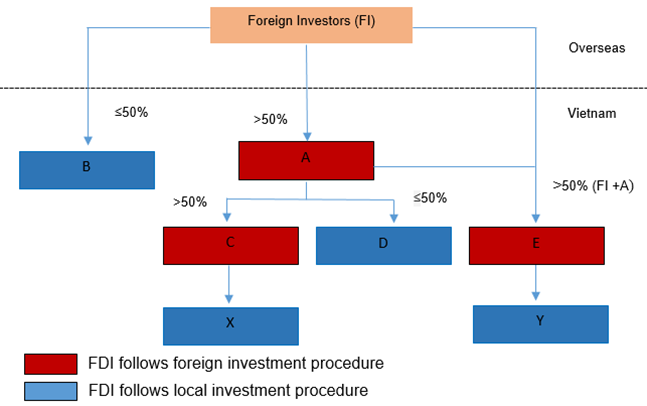

According to the new regulations, the Land Law 2024 distinguishes this subject into Economic Organizations (“EO“) and Economic Organizations with foreign investment capital, while the REBL 2023 uses a common term Economic Organizations with foreign investment capital. Although the names are different, the scope of rights implementation for these entities has been adjusted consistently according to the guidance of the Investment Law:

- Economic organizations with foreign investment capital subject to conditions and investment procedures applicable to foreign investors (abbreviated as “EO following foreign investment procedures“): enjoy rights and fulfill obligations regarding land as well as conduct real estate business with limited scope (See A, C, and E in Table B below).

- The remaining economic organizations with foreign investment capital (abbreviated as “EO following domestic investment procedures“): enjoy rights and fulfill obligations regarding land as well as conduct real estate business with a broad scope like domestic organizations and individuals (See B, D, X, and Y in Table B below).

The reference to the Investment Law makes the provisions of this law and the REBL 2023, Land Law 2024 more consistent.

Specifically, the change in grouping enterprises with foreign investment capital can be visualized as follows:

Table A: Law on Real Estate 2014 and Land Law 2013

Table B: Law on Real Estate 2023 and Land Law 2024

With these new regulations, some EOs with foreign investment capital will be subject to conditions and procedures specified for domestic investors which are much more open than those for enterprises with foreign investment capital. For example, the scope of real estate business for company A with 70% foreign capital and company B with 5% foreign capital is the same according to the REBL 2014. Accordingly, companies A and B are not allowed to purchase, rent-to-buy houses and construction works for the purpose of sale, lease, or rent-to-buy. However, according to the new provisions of the REBL 2023, company B will be allowed to exercise the right to purchase, rent-to-buy houses and construction works for sale, lease, or rent-to-buy.

Although the unification of terminology between the REBL 2023 and the Investment Law 2020 through the REBL 2023’s reference to the Investment Law 2020 is a new provision, the classification of enterprises with foreign investment capital as mentioned above is not a new provision of the Investment Law 2020 but is a provision inherited from the Investment Law 2014. Nevertheless, during the implementation of the Investment Law 2014, we have seen many cases where enterprises with foreign investment capital with foreign capital ratios below 50% were not applied investment conditions and procedures like domestic investors. Therefore, as with the practical implementation of the Investment Law 2014 and the Investment Law 2020, we need to wait for further guidance from the Government and monitor the actual application of the law by state management agencies.

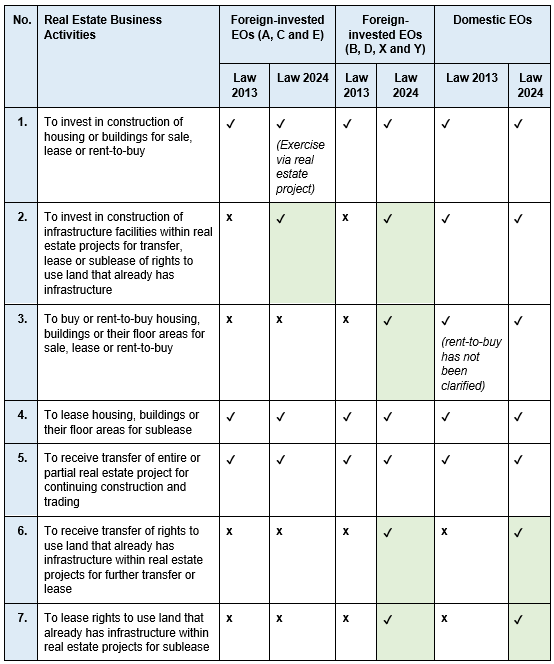

The scope of real estate business for both domestic and foreign organizations is expanded

Summarizing these new regulations, we can see the changes in the table below:

According to the table above, the right to conduct business in land use rights with technical infrastructure in real estate projects (receiving transfers for transfer, lease; leasing for sublease) is a completely new right, applicable to domestic EOs. Meanwhile, foreign EOs will be allowed to invest in constructing technical infrastructure in real estate projects to transfer, lease, sublease land use rights with technical infrastructure, which was previously reserved only for domestic EOs.

With the expanded scope of real estate business activities, EOs following domestic investment procedures have more options in terms of forms and real estate products. Accordingly, foreign investors can choose different M&A structures to access suitable real estate projects, for example:

(i) To establish Company A themselves to carry out real estate business activities applicable to EOs following foreign investment procedures;

(ii) To establish Companies A, C, and X themselves; use X to implement real estate projects according to the broad scope applicable to EOs following domestic investment procedures;

(iii) To cooperate with domestic investors to establish Company B to be able to immediately implement real estate projects according to the broad scope applicable to EOs following domestic investment procedures.

Thus, the provisions of the new law will significantly affect the investment structure, the way investors acquire land, and the financial aspects of real estate projects. Understanding the new regulations and following how these regulations are applied in practice will help real estate businesses better prepare in planning, managing, and implementing projects.

[1] Article 5.7, Land Law 2013

Download the PDF version of this article here.